The Only Guide for Stonewell Bookkeeping

Wiki Article

Not known Incorrect Statements About Stonewell Bookkeeping

Table of ContentsStonewell Bookkeeping for DummiesStonewell Bookkeeping Fundamentals ExplainedThe Buzz on Stonewell BookkeepingA Biased View of Stonewell BookkeepingLittle Known Facts About Stonewell Bookkeeping.

Every service, from hand-crafted towel manufacturers to game designers to dining establishment chains, gains and spends cash. You may not totally understand or even begin to totally value what an accountant does.The history of bookkeeping go back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained documents on clay tablet computers to keep accounts of purchases in remote cities. In colonial America, a Waste Schedule was generally used in bookkeeping. It contained an everyday diary of every purchase in the chronological order.

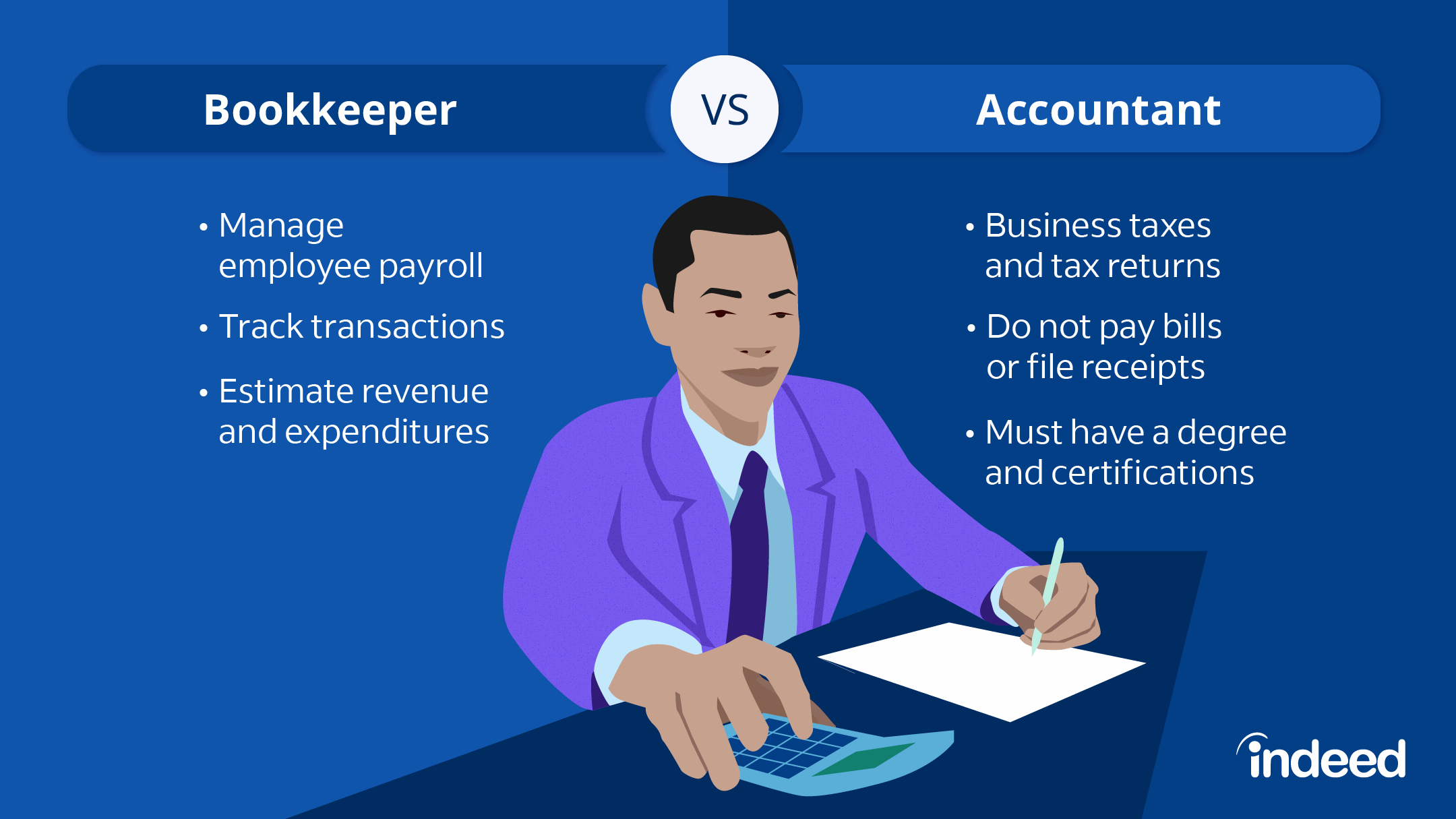

Tiny services may rely exclusively on an accountant initially, but as they expand, having both specialists on board ends up being progressively beneficial. There are two major sorts of accounting: single-entry and double-entry accounting. documents one side of a monetary transaction, such as adding $100 to your expense account when you make a $100 purchase with your credit history card.

The Single Strategy To Use For Stonewell Bookkeeping

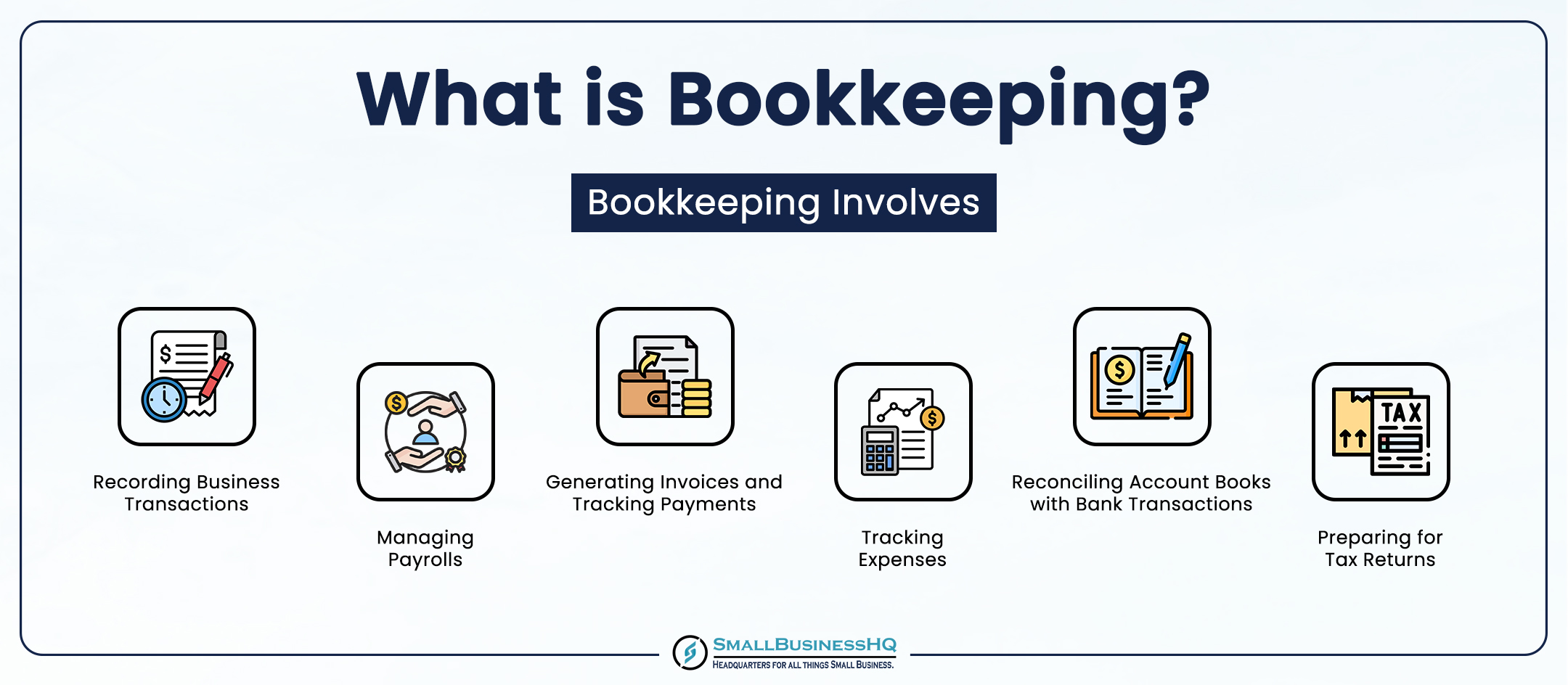

involves recording monetary deals by hand or utilizing spread sheets - small business bookkeeping services. While low-cost, it's time consuming and susceptible to errors. uses tools like Sage Cost Management. These systems automatically sync with your charge card networks to provide you charge card purchase information in real-time, and instantly code all data around expenses including tasks, GL codes, areas, and groups.They ensure that all documents complies with tax obligation regulations and regulations. They check cash money flow and routinely create financial records that assist crucial decision-makers in an organization to push the company forward. In addition, some accountants also help in optimizing payroll and invoice generation for a company. A successful accountant requires the complying with skills: Precision is key in economic recordkeeping.

They generally start with a macro perspective, such as an annual report or a profit and loss statement, and after that pierce right into the information. Bookkeepers guarantee that supplier and client records are constantly up to date, also as individuals and services modification. They may additionally need to coordinate with other departments to guarantee that everyone is making use of the very same data.

The Ultimate Guide To Stonewell Bookkeeping

Getting in costs right into the bookkeeping system allows for accurate planning and decision-making. This aids services receive repayments quicker and enhance cash flow.Include internal auditors and contrast their counts with the recorded worths. Bookkeepers can function as consultants or in-house staff members, and their compensation differs depending on the nature of their employment.

Consultants commonly charge by the hour but might supply flat-rate bundles for details tasks., the typical bookkeeper salary in the United States is. Keep in mind that incomes can vary depending on experience, education, location, and market.

Consultants commonly charge by the hour but might supply flat-rate bundles for details tasks., the typical bookkeeper salary in the United States is. Keep in mind that incomes can vary depending on experience, education, location, and market.3 Easy Facts About Stonewell Bookkeeping Explained

A few of the most usual documentation that organizations have to submit to the federal government includesTransaction information Financial statementsTax conformity reportsCash flow reportsIf your accounting is up to day all year, you can avoid a ton of anxiety throughout tax season. Accounting. Persistence and interest to information are crucial to better accounting

Seasonality is a component of any kind of job in the world. For bookkeepers, seasonality suggests durations when settlements come flying in through the roof covering, where having superior job can come to be a major blocker. It becomes essential to expect other these moments ahead of time and to complete any backlog prior to the stress period hits.

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Preventing this will lower the danger of causing an IRS audit as it supplies an exact representation of your finances. Some usual to maintain your personal and business funds different areUsing a company credit rating card for all your service expensesHaving different monitoring accountsKeeping receipts for personal and overhead separate Imagine a globe where your accounting is done for you.These combinations are self-serve and need no coding. It can instantly import data such as employees, tasks, categories, GL codes, divisions, job codes, cost codes, taxes, and extra, while exporting expenses as expenses, journal entrances, or credit card fees in real-time.

Think about the complying with ideas: An accountant that has worked with businesses in your sector will much better recognize your particular demands. Ask for referrals or examine on the internet evaluations to ensure you're employing someone trusted.

Report this wiki page